2025 Gifting Maximum

2025 Gifting Maximum. But even if you exceed that amount, there are some. 2025 gift tax exemption limit:

Remaining lifetime exemption limit after gift: In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

What Is The Limit On Gift Tax For 2025 Rory Walliw, In 2025, you can give gifts of up to $18,000 to as many people as you want without any tax or reporting requirements. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

California Raises Campaign Contribution and Gift Limits for 20232024, In 2025, you can give gifts of up to $18,000 to as many people as you want without any tax or reporting requirements. And because it’s per person, married couples can exclude double that in lifetime.

2025 retirement contribution limits Early Retirement, For 2025, the annual gift tax limit is $18,000. This year marks the highest annual gift tax exclusion.

Fsa 2025 Contribution Limits 2025 Calendar, 2 you’ll have to report. 2025 lifetime gift tax exemption limit:

401k Maximum Contribution Limit Finally Increases For 2019, The annual gift tax exclusion of $18,000 for 2025 is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax. And because it’s per person, married couples can exclude double that in lifetime.

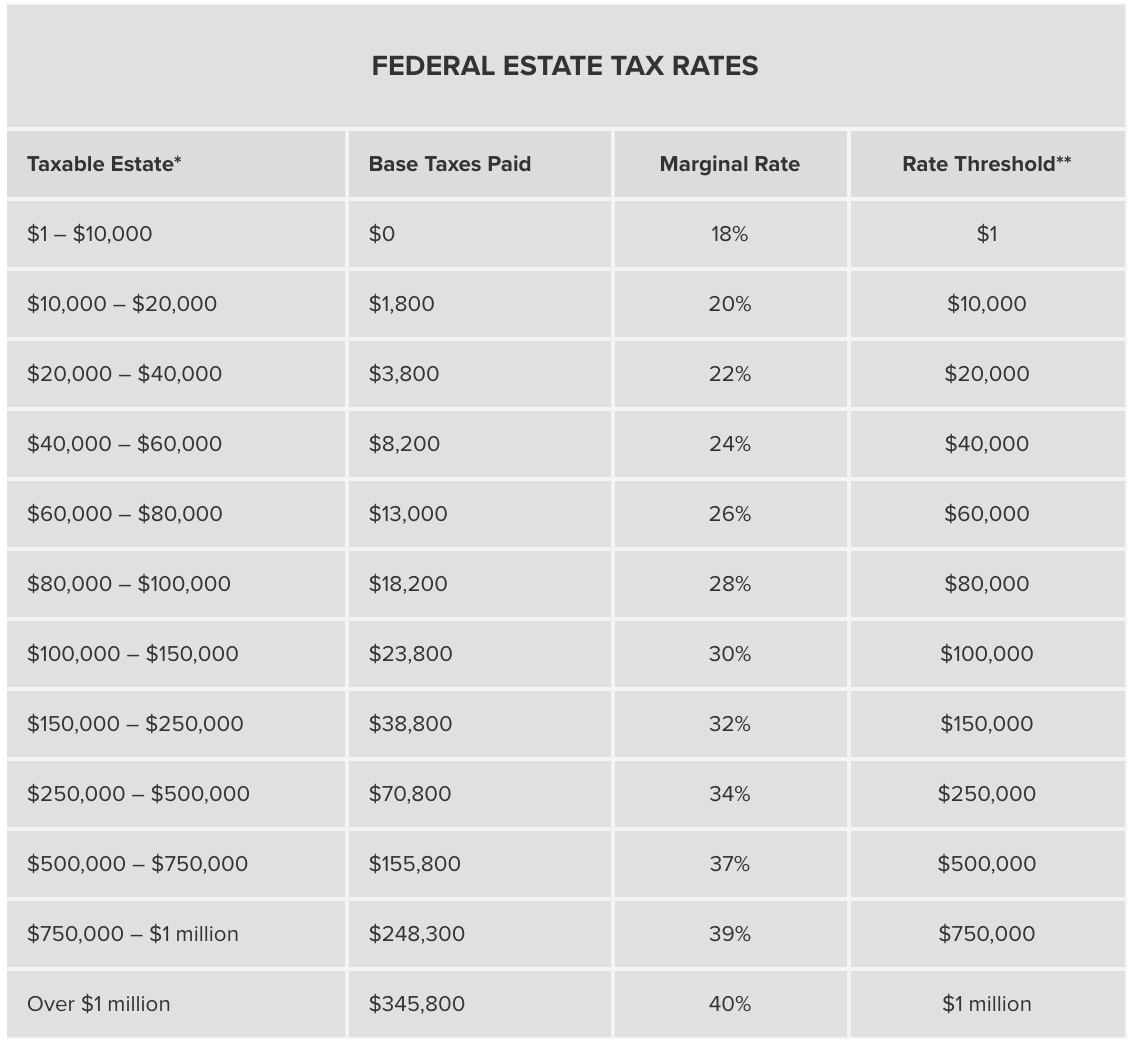

Fed Gift Tax Rate Hot Sex Picture, 2025 lifetime gift tax exemption limit: The annual gift tax exclusion of $18,000 for 2025 is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax.

Gift and Estate Tax Changes Coming in 2025, What You Need to Know to, The gift tax limit (or annual gift tax exclusion) for 2025 is $17,000 per recipient. In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

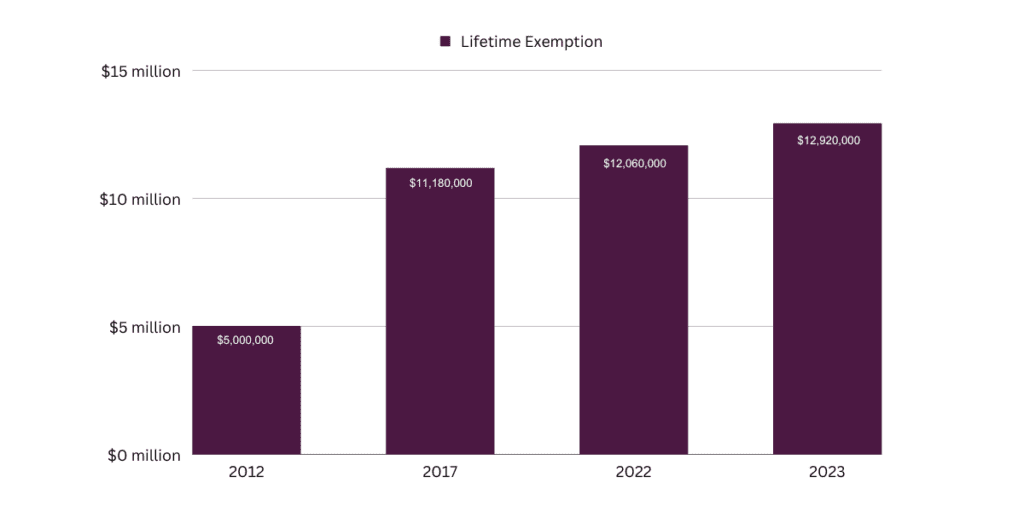

2025 IRS Gift Limit, Because the bea is adjusted annually for inflation,. As of 2025, your lifetime exclusion is $12.06 million.

7 Greatest Flower Supply Providers for Seamless Gifting 2025, In 2025, you can give gifts of up to $18,000 to as many people as you want without any tax or reporting requirements. Annual gift tax limit for 2025 the annual gift tax limit is $18,000 per person in 2025.

IRS Increases Gift and Estate Tax Thresholds for 2025, As of 2025, your lifetime exclusion is $12.06 million. Married couples can each gift $18,000 to the same person, totaling $36,000, up.

Known as the annual gift tax exclusion, the amount for 2025 is $18,000 per individual or $36,000 per married couple.

Proudly powered by WordPress | Theme: Appointment Blue by Webriti